Top 10 Identity Theft Protection Services of 2024 to Keep You Safe

Disclosure: Wizards of Technology might earn a small commission when you click on links through this site and make purchases. The earning of this affiliate commission in no way affects how services are reviewed, ranked or rated.

The most effective identity theft protection services available online today make it super easy for people to take better care of their personal and financial information from falling into the hands of unscrupulous cybercriminals who harvest this sensitive information and sell it on the dark web.

Scammers and hackers use this info to steal people’s identities and carry out a range of fraudulent activities. We have carefully scoured the web to find the best identity theft protection services and bring you the best choice.

The number one brand that made it to the top of our list is Aura, which includes antivirus software, a VPN, a password manager, and more, all at an amazing price. Let’s dive straight in to discover more about Aura and nine more of today’s best identity theft protection companies.

Best Identity Theft Protection Services of 2024

Our dedicated team of expert researchers found these top 10 identity theft protection services were far better than all the rest.

- Aura: Best Overall ID Theft Protection

- LifeLock: Best Protection with Antivirus

- Identity Guard: Best AI ID Theft Protection

- IdentityIQ: Top Social Security Monitoring

- ID Shield: Best Family Plan Bundles

- ID Watchdog: Best ID Theft Resolution

- IdentityForce: Best for Child Protection

- Zander Insurance: Best Insurance Bundle

- IDnotify: Great Value for Money

- PrivacyGuard: Best Customer Support

Aura

Highlights

- Best overall identity theft protection service

- Reasonably priced

- Available for families, individuals, or couples

- Includes Avira malware protection

- Built-in VPN (virtual private network)

- Experian credit scores lock button

- 2FA, and bank, card accounts monitored

Review

After carefully comparing today’s best ID theft protection companies, Aura came out on top. If you want to prevent identity theft, consider using Aura before other ID theft protection services.

They are the best at stopping identity thieves from stealing your sensitive information, and they have an annual credit report with three credit bureaus monitored. Aura provides the best identity theft services available online today and has everything you need to protect your identity, devices, and data.

One of the things we like most about Aura is that it has incredibly effective malware protection. You also have VPN access and a password manager.

It’s easy to use, and some other security software features you can look forward to are Anti-tracking, Ad blocking, Antivirus, and Safe Browsing extensions.

Regardless of which Aura price plan you go for, you are guaranteed to get the most effective identity protection tools. We also like that the family plan comes with child safety tools, including child three-bureau credit freeze assistance, safe gaming with cyberbullying alerts, and other parental controls.

It also has identity theft insurance up to the tune of $1 million. In short, try Aura first if you’re looking for the best identity protection. You won’t be disappointed.

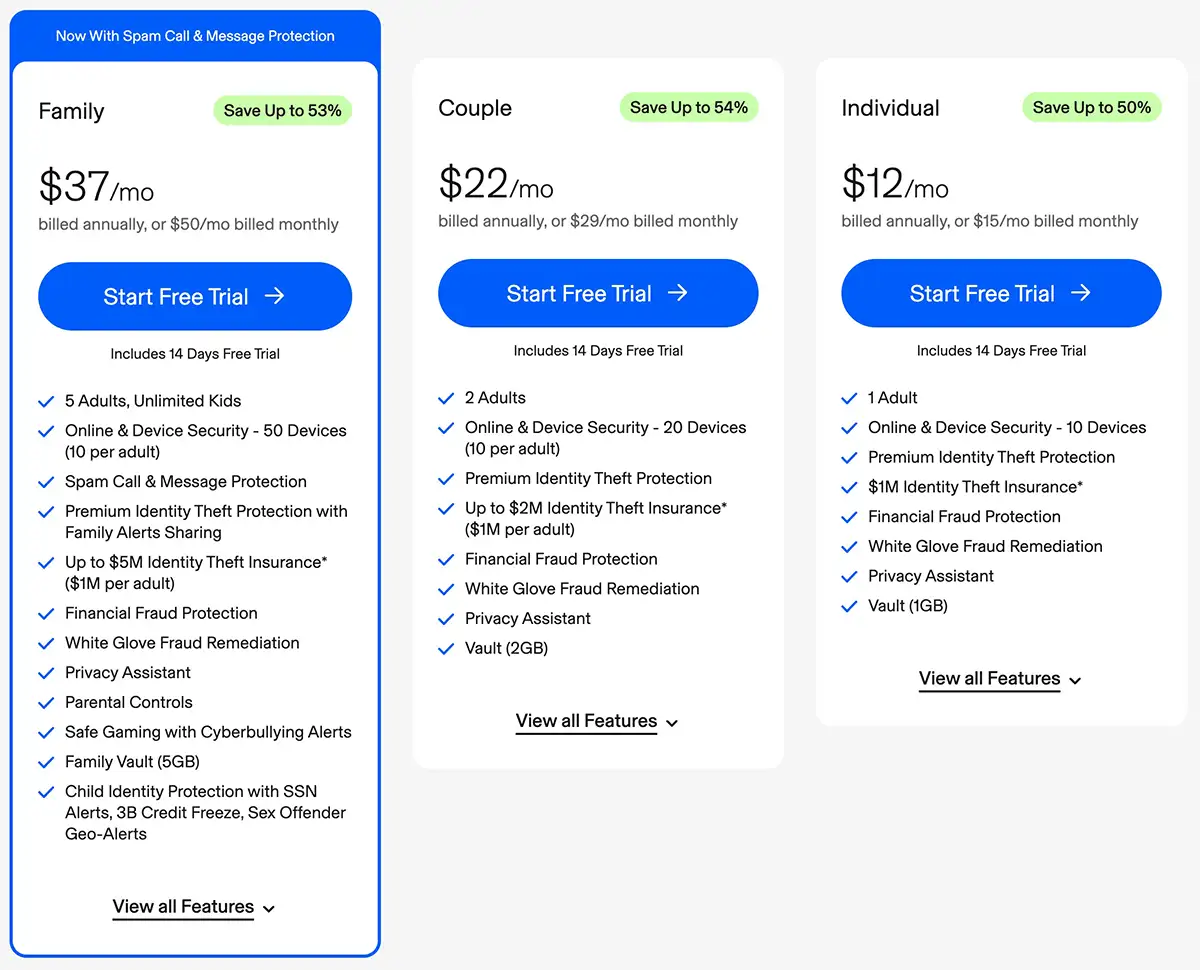

Aura Pricing

Aura 1 Year Plan Pricing

- Family: $37 / month billed annually (Save up to 53%)

- Couple: $22 / month billed annually (Save up to 54%)

- Individual: $12 / month billed annually (Save up to 50%)

Aura Monthly Plan Pricing

- Family: $50 / month

- Couple: $29 / month

- Individual: $12 / month

LifeLock

Highlights

- Fantastic for all-around identity protection

- Monitors 3 major credit bureaus + 3 annual credit reports

- Can include Norton’s 360 security suite

- ID-theft assistance up to $3 million

- 2FA, and bank, card accounts monitored

- Investment account monitoring

- Instant credit freeze

Review

LifeLock is an ideal identity theft protection service for anyone from individuals or couples to small and large families, especially if you’re looking for comprehensive ID theft protection that won’t let you down. It offers the best credit monitoring services out of ten of the best identity theft protection services featured on this page.

The company offers a range of ID protection and monitoring options, including things like checking savings account application alerts, home title monitoring, identification verification monitoring, and stolen wallet protection.

ID theft protection services cost anywhere from around $10 to $20 p/m in the first twelve months, and depending on the type of monitoring plan you go for, reimbursements can be anywhere from $25K up to $1M. In fact, the family plan offered by LifeLock offers up to $3M in identity theft insurance on any stolen funds.

All three major credit bureaus are monitored (Equifax, Experian, and TransUnion), and this company will always check for suspicious activity on your bank and investment accounts and credit/debit cards, plus monthly credit reports.

When it comes to security, LifeLock Ultimate Plus can be backed up with Norton 360, which covers just about all your online identity fraud security needs. It may not be as cheap as the services featured on this page, but you are getting excellent protection for your money.

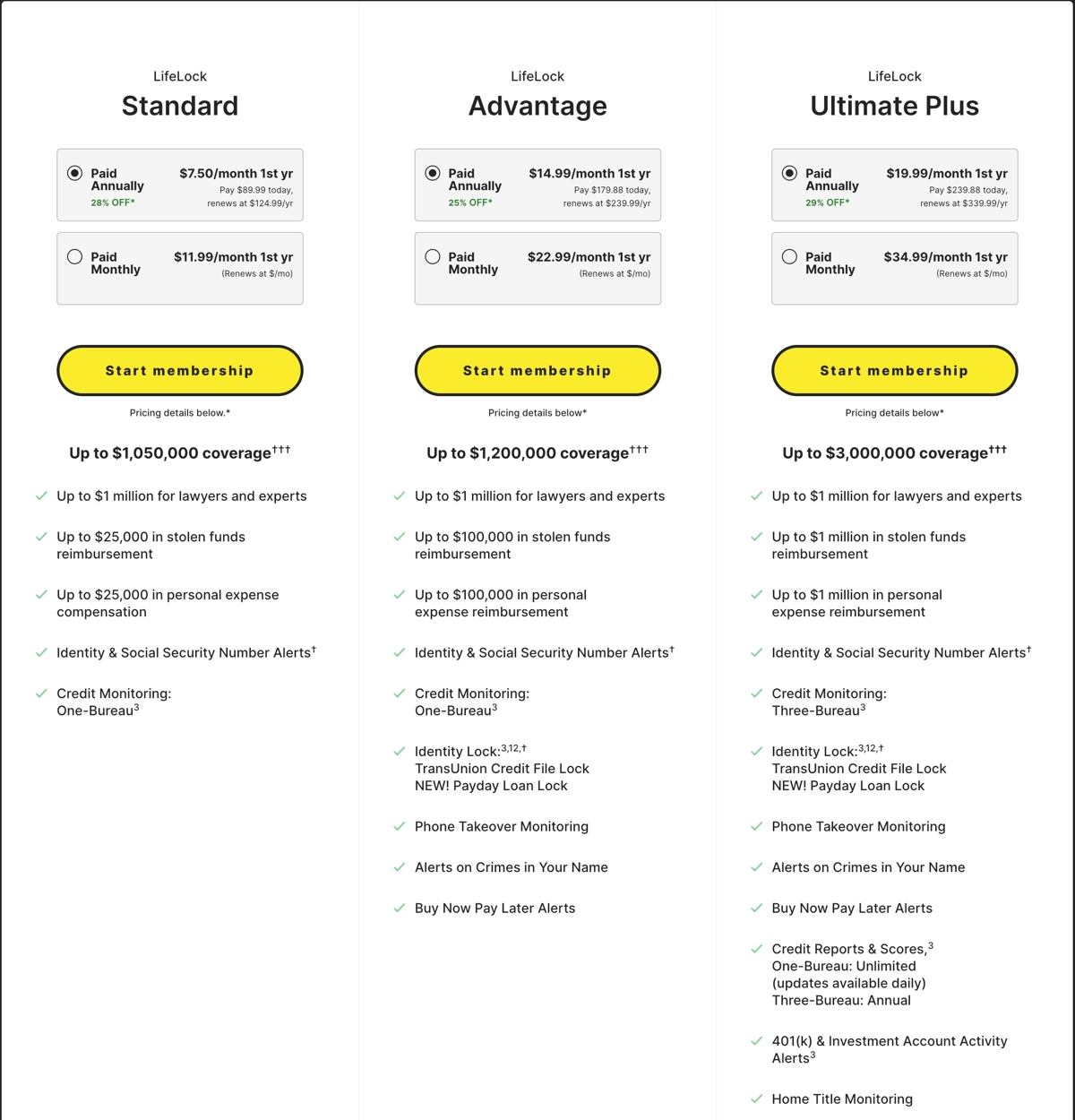

LifeLock Pricing

LifeLock 1 Year Plan Pricing for 1 Adult

- Standard: $7.50 / month billed annually (Save up to 28% in the first year)

- Advantage: $14.99 / month billed annually (Save up to 54% in the first year)

- Ultimate Plus: $19.99 / month billed annually (Save up to 50% in the first year)

LifeLock Monthly Plan Pricing 1 Adult

- Standard: $11.99 / month

- Advantage: $22.99 / month

- Ultimate Plus: $34.99 / month

LifeLock 1 Year Plan Pricing for 2 Adult

- Standard: $12.49 / month billed annually (Save up to 40% in the first year)

- Advantage: $23.99 / month billed annually (Save up to 40% in the first year)

- Ultimate Plus: $32.99 / month billed annually (Save up to 42% in the first year)

LifeLock Monthly Plan Pricing 2 Adult

- Standard: $23.99 / month

- Advantage: $45.99 / month

- Ultimate Plus: $69.99 / month

LifeLock 1 Year Plan Pricing for 2 Adult + 5 Kids

- Standard: $18.49 / month billed annually (Save up to 40% in the first year)

- Advantage: $29.99 / month billed annually (Save up to 40% in the first year)

- Ultimate Plus: $38.99 / month billed annually (Save up to 42% in the first year)

LifeLock Monthly Plan Pricing 2 Adult + 5 Kids

- Standard: $35.99 / month

- Advantage: $57.99 / month

- Ultimate Plus: $79.99 / month

Identity Guard

Highlights

- Up to $1 million identity theft insurance

- Best identity restoration services

- Powered by IBM's Watson

- Best ID theft protection on a budget

- 2FA, and bank, card accounts monitored

- Investment account monitoring

- Password manager + social media monitoring

Review

Identity Guard (Aura is Identity Guard's parent company) has a great stolen funds reimbursement policy that in the unlikely event your financial accounts, like a digital wallet account or bank account, are compromised; you can get up to $1 million in identity theft insurance.

This company is known for its reliable and solid identity theft protection services, and there are several plans to choose from, depending on your needs. Each plan is fairly priced and has some great features.

Examples include monitoring social media, a password manager, and three credit bureaus credit monitoring services. Being powered by IMB's Watson means the focus of this company is on preventing identity fraud by offering the best identity theft protection plans and providing the best identity protection services.

Remember to use the Identity Guard Dark Web scanner tool to track sensitive data leaks. Don't forget that this all comes at an extremely reasonable price.

Unfortunately, the cheapest plan doesn't come with credit scores. You'll need at least the mid-range plans for this. It also comes with an Experian credit lock, making it easy to freeze your credit during an emergency.

Identity Guard is reasonably priced for what you get (with regards to identity theft protection services, identity theft insurance, and dark web monitoring). Their identity theft protection plan is one of the best.

If you want the Avira malware protection and a VPN included in your plan, you may want to go with Aura instead. However, Identity Guard has pretty much everything you could want in terms of protection.

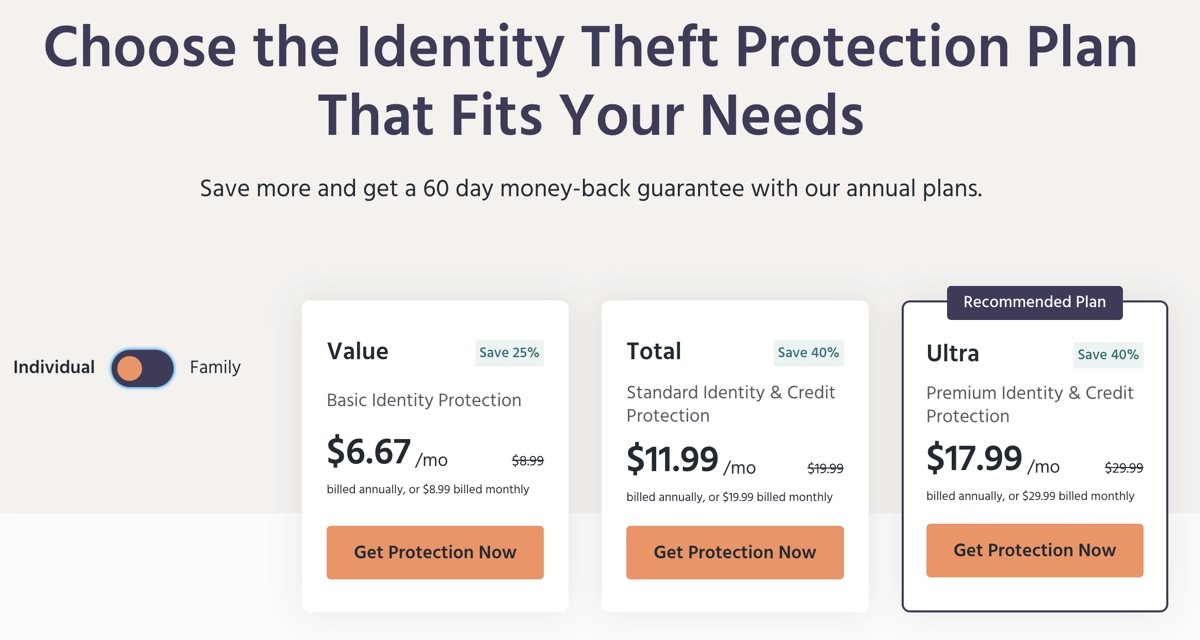

Identity Guard Pricing

Identity Guard 1 Year Plan Pricing for 1 Adult

- Value: $6.67 / month billed annually (Save up to 25%)

- Total: $11.99 / month billed annually (Save up to 40%)

- Ultra: $17.99 / month billed annually (Save up to 40%)

Identity Guard Monthly Plan Pricing 1 Adult

- Value: $8.99 / month

- Total: $19.99 / month

- Ultra: $17.99 / month

Identity Guard 1 Year Plan Pricing for 5 Adults + Unlimited Kids

- Value: $10 / month billed annually (Save up to 33%)

- Total: $17.99 / month billed annually (Save up to 40%)

- Ultra: $23.99 / month billed annually (Save up to 40%)

Identity Guard Monthly Plan Pricing 5 Adults + Unlimited Kids

- Value: $14.99 / month

- Total: $29.99 / month

- Ultra: $17.99 / month

IdentityIQ

Highlights

- Up to $1 million identity theft insurance coverage

- Secure Max Plan offers free coverage for under 24s

- Comprehensive identity and credit monitoring

- Excellent identity recovery services

- The most reasonably priced identity protection service

- The best protection from financial and health insurance fraud

- More thorough monitoring and fraud alerts than other companies

Review

IdentityIQ has one main objective: to prevent identity theft and protect its customers in the best way possible from a broad range of data breaches, including everything from health insurance fraud to financial account fraud. They also focus heavily on social security fraud.

The dedicated team at IdentityIQ monitor social security number (SSN) activity and detects anomalies/fraudulent activity, and when it comes to keeping customers in the loop, they are more committed to alerting customers that any other service, especially when SSNs are used, either by the user or anyone else who has obtained it.

This service also comes with a VPN, and should identity theft happen, there are several tools that can help recover stolen funds. They also provide an identity restoration service and identity theft insurance worth up to $1 million.

You can look forward to frequent alerts to any changes in your credit scores and personal ID on your accounts. The system detects if new credit/trade lines are opened under your name.

The credit monitoring service is fantastic. Equifax, Experian, and TransUnion are the three credit bureaus where you can get monthly, bi-annual, or annual credit reports.

Finally, with the Secure Max and Secure Pro plans, IdentityQ carries out checks for national and international arrest and conviction records under your name.

They also send out registry alerts for change of address requests and provide lost wallet services. Bitdefender antivirus can also be included at an extra cost.

IdentityIQ Pricing

IdentityIQ 1 Year Plan Pricing

- Secure Basic: $5.94 / month billed annually (Save up to 15%)

- Secure Plus: $8.50 / month billed annually (Save up to 15%)

- Secure Pro: $16.99 / month billed annually (Save up to 15%)

- Secure Max: $25.50 / month billed annually (Save up to 15%)

IdentityIQ Monthly Plan Pricing

- Secure Basic: $6.99 / month

- Secure Plus: $9.99 / month

- Secure Pro: $19.99 / month

- Secure Max: $29.99 / month

ID Shield

Highlights

- Up to $2 million identity theft insurance

- Excellent dark web/social media monitoring

- Credit reporting

- Credit and debit cards monitored

- Investment account monitoring

- Identity theft prevention

- Superb identity recovery assistance

Review

IDShield is one of the best identity theft protection services with regard to its family plans. Plus, it comes with impressive identity theft insurance worth up to $2 million, whereas most others only cover up to $1M. In other words, you wouldn't have to worry about legal fees after a data breach with this fantastic credit protection.

This company has a specialist team of licensed PIs (private investigators) to deal with ID fraud, and the support attached to this service is available 24 hours per day.

Should your ID be compromised in any way, IDShield is committed to working your case through until any financial damages have been reversed/reimbursed and until your sensitive data is completely restored.

You can also look forward to credit monitoring/monthly credit scores (VantageScore credit reports), cutting-edge identity theft protection and prevention, top-notch services, and excellent value for money for small and large families.

This relatively inexpensive service also offers malware protection, a built-in VPN, and other useful online security software and tools. IDShield is one of the most cost-effective ways to protect your identity online and monitor your credit.

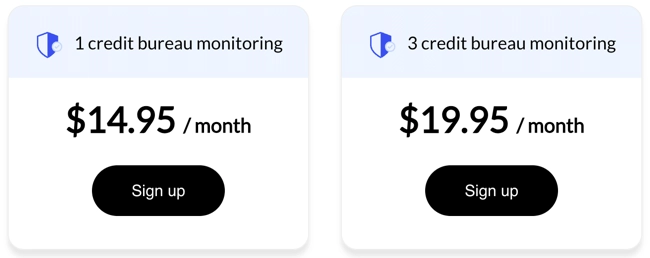

IDShield Pricing

IDShield Individual Plan Pricing

- 1 Credit Bureau Monitoring: $14.95 / month

- 3 Credit Bureau Monitoring: $19.95 / month

IDShield Family Plan Pricing

- 1 Credit Bureau Monitoring: $29.95 / month

- 3 Credit Bureau Monitoring: $34.95 / month

ID Watchdog

Highlights

- Up to $1 million identity theft insurance

- Password manager and VPN add-ons available

- Dashboard is user-friendly, easy to navigate

- One month free trial

- Owned by one of the biggest credit bureaus

- Best identity theft resolution

- Great credit report monitoring

Review

ID Watchdog is another one of the world's best 'standard' identity theft protection services, with just a couple of different plans to choose from. The more basic plan, Select (for an individual), offers just one bureau credit monitoring service, whereas the Premium family plan (two adults, up to four children) includes all three credit bureau monitoring services.

This company is great if you're looking for basic identity protection. In the more expensive of the two plans, you can also count on several other identity theft protection services, such as a VPN, password manager, a subprime loan blocker, and a few other great features.

It's easy to download, the dashboard/interface is really easy to use, and the main features you'll need are quick to find. It may have slightly less functionality, features, and services than some of the other identity theft protection providers, but it protects you just as well.

The credit and identity monitoring is sufficient, and they also guarantee up to a million in identity theft insurance. Equifax owns this company, and their credit report is highly accurate and always provides the most current information with a three bureau credit monitoring system Premium plan only, don't forget).

The other thing we like about ID Watchdog is that in the event that identity theft occurs after any dark web activity, they have superb identity recovery assistance. It's also one of few identity theft protection service providers offering ID recovery assistance for non-subscribers.

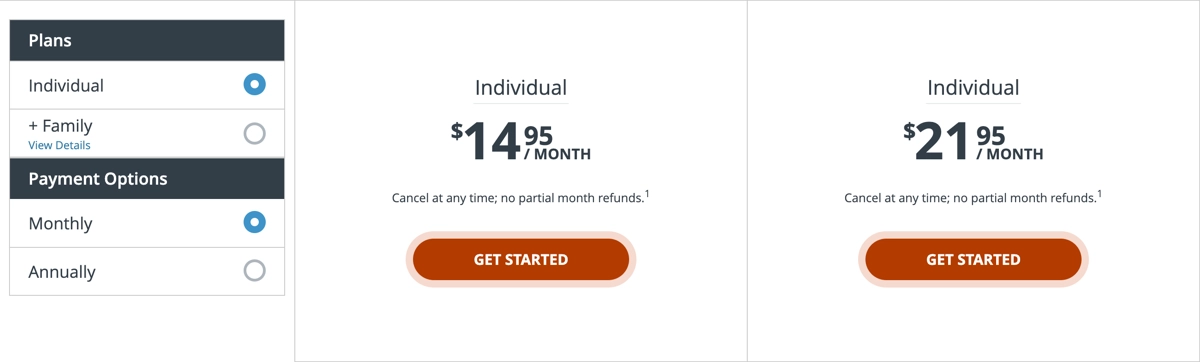

ID Watchdog Pricing

ID Watchdog Individual Plan Pricing Yearly

- 1 Credit Bureau Monitoring: $150 / year

- 3 Credit Bureau Monitoring: $220 / year

ID Watchdog Individual Plan Pricing Monthly

- 1 Credit Bureau Monitoring: $14.95 / month

- 3 Credit Bureau Monitoring: $21.95 / month

ID Watchdog Family Plan Pricing Yearly

- 1 Credit Bureau Monitoring: $240 / year

- 3 Credit Bureau Monitoring: $350 / year

ID Watchdog Family Plan Pricing Monthly

- 1 Credit Bureau Monitoring: $23.95 / month

- 3 Credit Bureau Monitoring: $34.95 / month

Identity Force

Highlights

- Up to $1 million stolen funds reimbursement (all plans)

- Three bureau credit monitoring

- Dark web monitoring

- Free trial for one month

- Best identity theft protection service for families

- Includes features like fraud alerts + VPN

- Credit freeze assistance, investment account alerts, + more

Review

Identity Force is one of the highest-rated identity theft protection companies out there (excellent family plans). All three credit bureaus are monitored, along with your bank account, data breaches, dark web monitoring, and even a credit score simulator.

They have several plans, and they all come with up to $1M to cover stolen funds. Their family plan is one of the best identity theft protection services for families of all sizes, and they also provide child identity theft protection (for an additional charge).

If an identity thief does steal your sensitive data, certified investigators are assigned to your case to help resolve it, which is on standby 24/7. You can also count on 24/7 identity threat alerts, a user-friendly mobile application, and a smart SSN tracker.

They return monthly credit scores from the major credit reporting agencies, and their service also includes anti-phishing, anti-keylogging software, monitoring social media, and more.

It has two-factor authentication at sign-in. They have a financial advisor service and a bill payment history to help you stay on top of things.

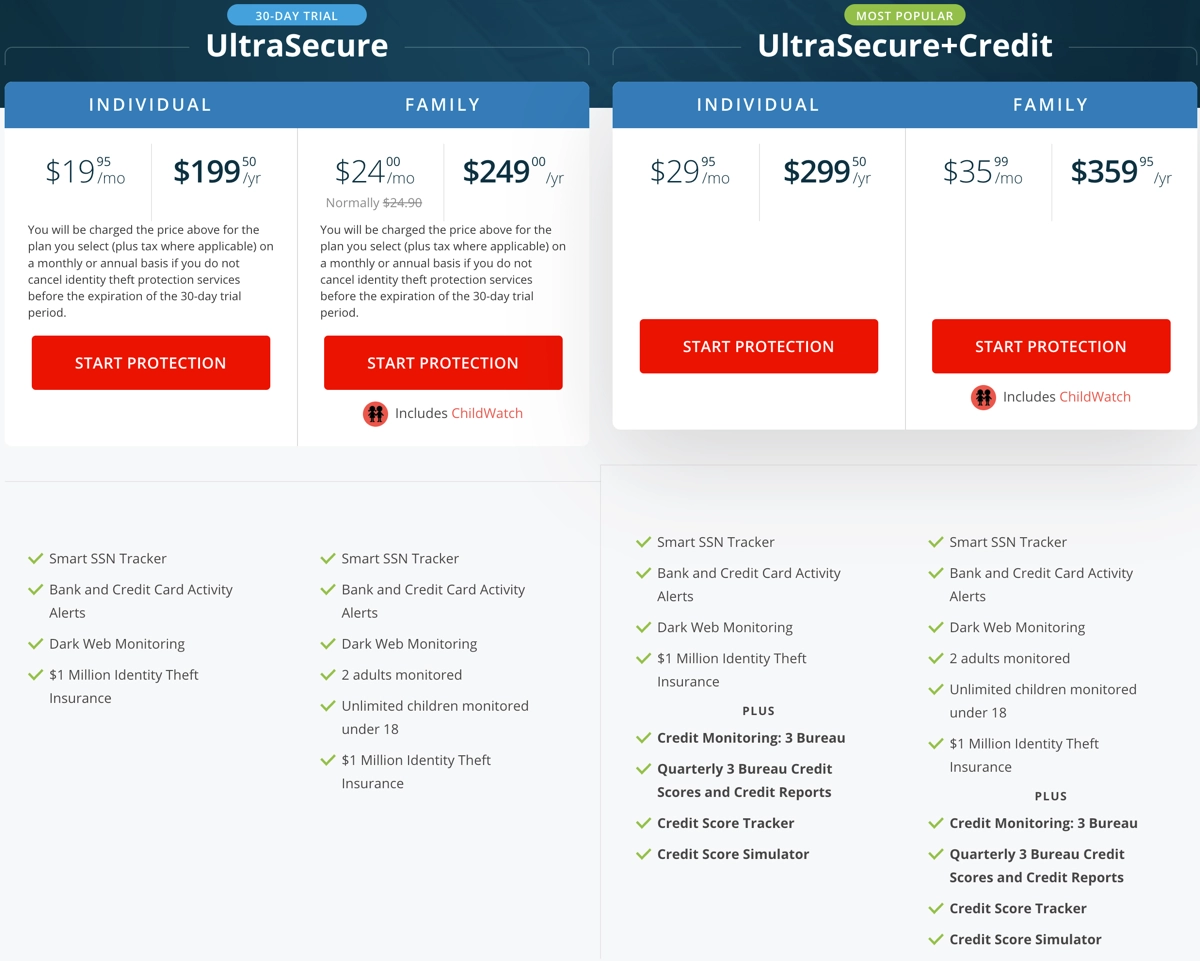

Identity Force Pricing

Identity Force 1 Year Plan Pricing for an Individual

- UltraSecure: $199.50 / year billed annually

- UltraSecure+Credit: $299.50 / year billed annually

Identity Force Monthly Plan Pricing for an Individual

- UltraSecure: $19.95 / month

- UltraSecure+Credit: $29.95 / month

Identity Force 1 Year Plan Pricing for the Family

- UltraSecure: $249 / year billed annually

- UltraSecure+Credit: $359.95 / year billed annually

Identity Force Monthly Plan Pricing for the Family

- UltraSecure: $24 / month

- UltraSecure+Credit: $35.99 / month

Zander Insurance

Highlights

- Great family plans

- Up to $1M id theft insurance

- Dark web monitoring

- Unique features like home title fraud protection

- VPNs and other add-ons available

- Three bureau credit reporting agencies monitored

- Certified recovery specialists available 24/7

Review

Zander is often regarded as one of the best identity theft protection service providers for people who find themselves on a budget. Although it's one of the most affordable, it doesn't mean to say it offers far less protection. In fact, it's quite the opposite.

The company offers three bureau credit monitoring services with yearly credit reports, and there are two identity theft packages to choose from – Essential and Elite Cyber Bundle.

Some of the identity theft protection services, features and tools in the Elite bundle are fraud alerts, up to $1M ID theft insurance, identity recovery expenses, antivirus software, a VPN, account-takeover monitoring, an account recovery specialist and more.

The main types of identity theft they monitor are title fraud, tax fraud, employment fraud, and any medical records in your name. You can also count on ID theft prevention with their identity theft protection service.

In addition to the ID theft insurance cover, they also have one or two options for adult dependent coverage. Their dashboard is easy to navigate, and the service is ideal if you can't afford identity theft protection from any of today's slightly more expensive companies.

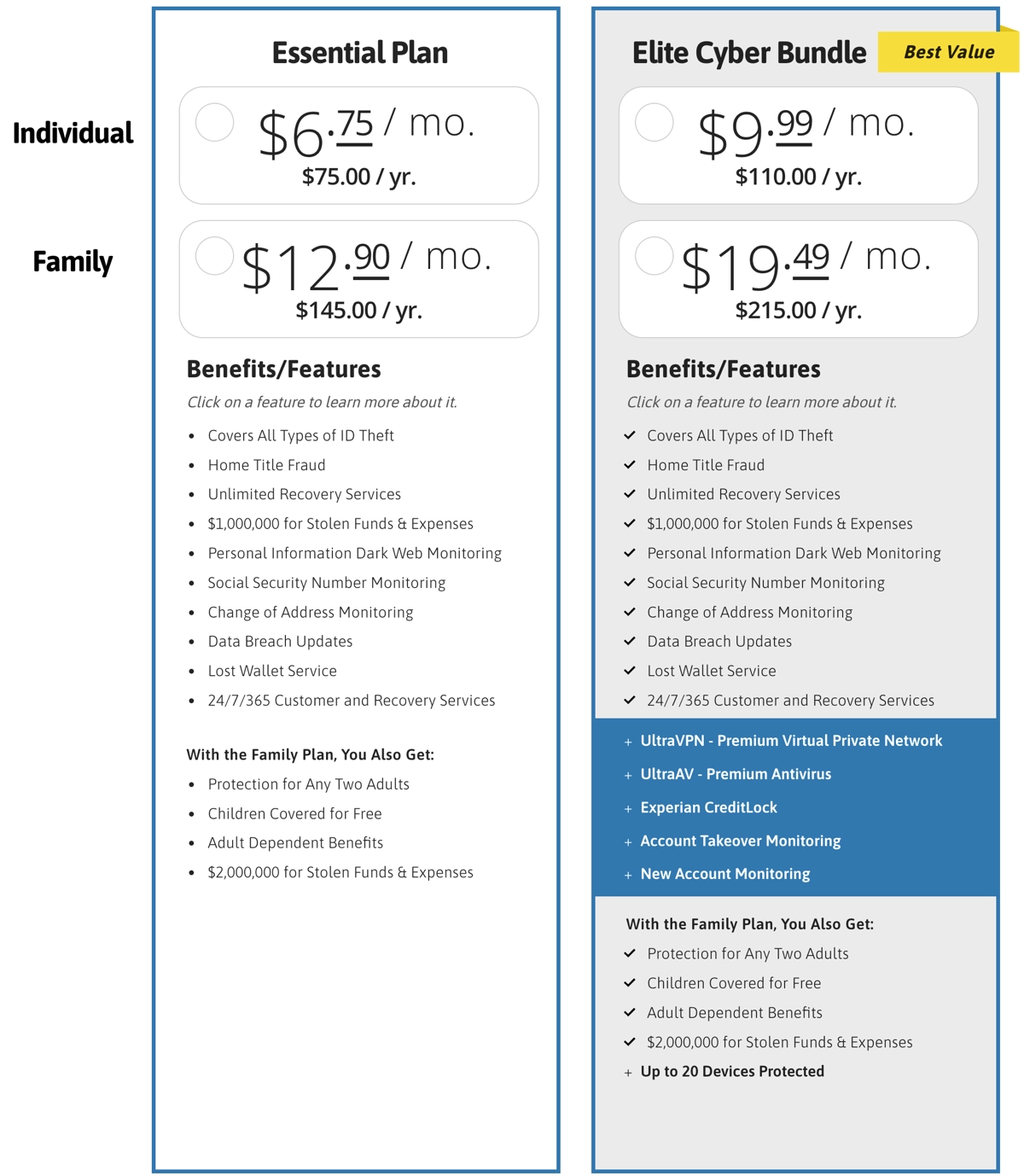

Zander Insurance Pricing

Zander Insurance 1 Year Plan Pricing for an Individual

- Essential Plan: $75 / year billed annually

- Elite Cyber Bundle: $110 / year billed annually

Zander Insurance Monthly Plan Pricing for an Individual

- Essential Plan: $6.75 / month

- Elite Cyber Bundle: $9.99 / month

Zander Insurance 1 Year Plan Pricing for the Family

- Essential Plan: $145 / year billed annually

- Elite Cyber Bundle: $215 / year billed annually

Zander Insurance Monthly Plan Pricing for the Family

- Essential Plan: $12.90 / month

- Elite Cyber Bundle: $19.49 / month

IDnotify

Highlights

- Identity theft insurance up to $1M

- Three major credit bureaus monitoring

- Customisable alerts

- Affordable family plans

- Regular credit reports

- Social media + dark web monitoring

- Identity theft prevention

Review

ID Notify is one of the best-value-for-money identity theft services that help keep you and your family safe online, and they provide up to $1M ID theft insurance. Regular credit reporting is provided, and your credit score/credit report is brought to you by the major credit bureaus.

What we also like about this identity theft protection service provider is that it's operated by Experian. ID Notify provides plenty of alerts (e.g., applications in your name with payday lenders, about sex offenders in your area, and numerous other safety benefits).

Several plans are available for everyone, from individuals to large families, all at affordable prices. Their top-notch identity monitoring services, with dark web monitoring and social media monitoring, are always checking to see if your personal data is being used by anyone else.

They can also help you restore your ID should any of your sensitive information be compromised or used in any way by scammers/hackers. If there have been any data breaches, you will immediately be alerted.

This company offer fairly basic but straightforward and reliable/effective identity theft protection work systems to keep you and your family protected. It may not be the best identity theft protection company, but it's far from the worst and well worth looking into.

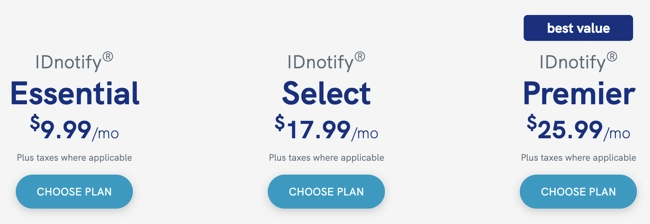

IDNotify Pricing

IDnotify Monthly Plan Pricing

- Essential: $9.99 / month

- Select: $17.99 / month

- Premier: $24.99 / month

Available Add-on Options to the Above Plans

- Family Plan: +$10 / month

- Child Protection Plan: +$5 / month

PrivacyGuard

Highlights

- Three bureau credit monitoring

- Up to $1M protection

- Several different plans available

- Dark web monitoring

- Known for its excellent customer service

- Low monthly rates

- Identity restoration and recovery services

Review

The thing that makes PivacyGuard different from all the other best identity theft protection services mentioned on this page is that they have one plan for ID protection and another for credit protection. Alternatively, you can get the two together with their Total protection plan.

This company has many benefits, including standard ID theft insurance worth up to $1,000,000, identity recovery assistance, credit monitoring, and ID theft prevention.

The company, as mentioned, is also well-known for its unrivalled levels of excellent customer service and availability.

In your 24/7 identity monitoring services, you can monitor your debit and credit card statements, bank account numbers and other financial account activity.

If there has been a data breach by identity thieves, you can take immediate action. Identity theft monitoring and prevention is their top priority, along with credit protection.

There are several different plans to choose from to suit all types of needs, and as a new member, don't forget that you can try any of their plans for just $1 for the first 14 days.

If you're looking for a reliable and affordable online identity protection service, you may like to try PrivacyGuard before trying any others.

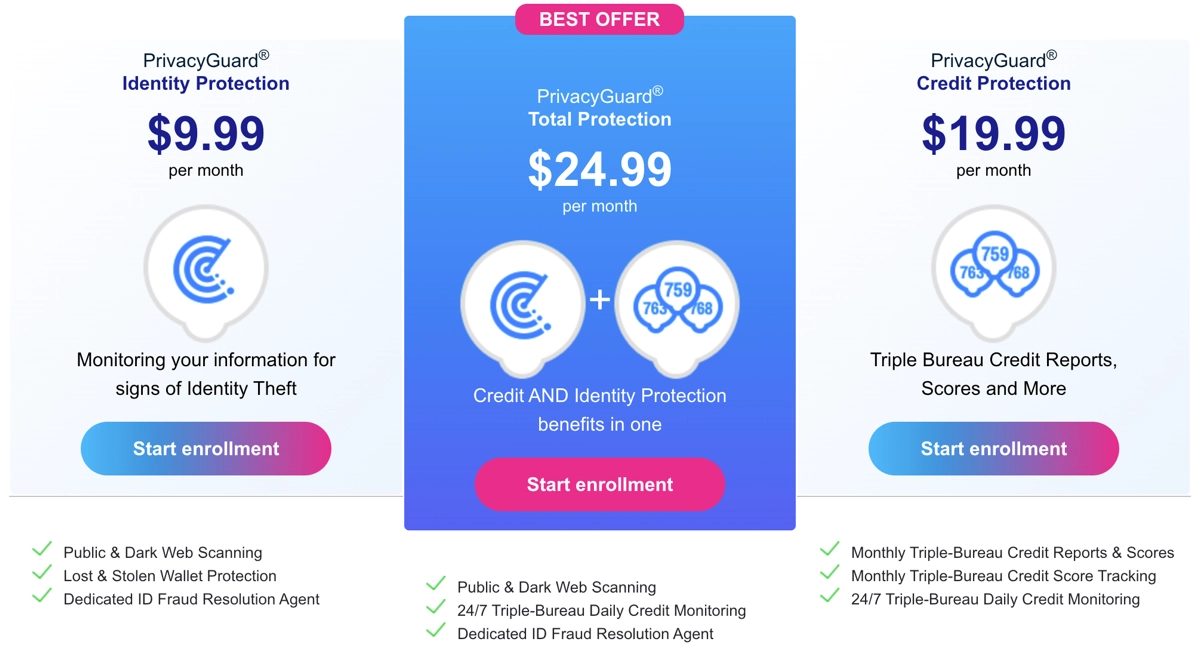

PrivacyGuard Pricing

PrivacyGuard Monthly Plan Pricing

- Identity Protection: $9.99 / month

- Credit Protection: $19.99 / month

- Total Protection: $24.99 / month

Rating and Ranking Factors for Theft Protection Services

When it comes to rating and ranking today's best identity theft protection services, several important factors must be considered, such as credit monitoring, identity monitoring, identity restoration service, and identity theft insurance.

Credit Monitoring

Credit monitoring is important because it keeps us updated with any changes that have occurred with our credit scores. It's important that today's best ID theft protection services at least one of the three market-leading credit bureaus (examples include Experian, Equifax and TransUnion).

Identity Monitoring

Identity monitoring is just as important. The companies featured on this page have this as one of their top priorities to keep you safe online.

They monitor your credit files and accounts and can immediately notify you of any suspicious activity so you can do something about it straight away. Remember, ID theft protection is so much more than merely monitoring credit/debit cards.

Identity Restoration Service

It's also important that the company you sign up to has a quick and reliable identity restoration specialist to help you get things back to normal.

If there is a data breach, it should be able to place a security freeze with each of the major nationwide credit bureaus, perhaps mediate calls with necessary third parties so you don't have to, help you file theft reports to the police, and educate you about the restoration process.

Identity Theft Insurance

There's no point in signing up to a company that provides no ID theft insurance. In most cases, you will find that the featured companies recommended on this page provide up to $1M in cover (in some cases, up to $2M or $3M).

The process of restoring your ID can be lengthy and costly, which sometimes requires legal assistance. The insurance doesn't prevent ID theft crimes from happening; it only covers certain financial losses, don't forget.

Recap of the Best Identity Theft Protection Services for 2024

Here is a quick recap of the five best identity theft protection services for 2024, which were slightly better than the others for one reason or another.

Although each company recommended on this site is far better than any others we found online, our dedicated team of expert researchers all agreed that these five companies deserved to be in the top 5 more than any others.

Here are the highlights that made Aura, LifeLock, Identity Guard, Identity IQ, and ID Shield stand out from the crowd.

Aura

Aura was our favourite company by far, offering the best overall identity theft protection for individuals and families. It's affordable, reliable, and offers credit monitoring from all three major bureaus.

The services provided by this company also include a VPN for extra online protection. They also have cyberbullying and online predator protection available, plus various other parental controls.

It's simple to use, includes a password manager, Avira malware protection, and has an Experian credit scores lock button.

Your credit/debit cards and accounts are monitored, and they have several other useful tools and services, like ad blocking, safe browsing extensions, and up to $1 million insurance coverage.

LifeLock

LifeLock was our second-highest-rated ID theft protection service, but it could just as easily have made it to our top spot. The only downside we could find was that it was slightly more expensive than some of the others.

Up to seven members of your family can be protected by LifeLock, which can also include Norton's 360 security suite. We found this company had the best offer for theft protection with antivirus software.

Their ID theft assistance is worth up to a staggering $3 million. It monitors the three major credit bureaus, along with investment account monitoring, and it comes with an instant credit freeze feature in the event of a data breach or any other fraudulent activity where your details are used unlawfully.

Your credit/debit cards and bank accounts are monitored, too, and your account is protected by two-factor authentication. LifeLock is great for everyone, from individuals to large families, and they have plenty of different plans to choose from to suit all online security needs.

Other services include stolen wallet protection, checking savings account application alerts, and even home title monitoring.

Identity Guard

Identity Guard is well known for having the best artificial intelligence ID theft protection (powered by IMB's Watson), and it has what we consider to be the quickest and most effective identity restoration service.

Identity Guard protects your financial accounts and credit/debit cards, and it also offers investment account monitoring services and has an added layer of security with two-factor authentication.

You can also count on social media monitoring, a password manager, and a great stolen funds reimbursement policy worth up to the tune of $1M.

It's by far the best value for money online ID theft protection service, and there are many plans to choose from. Identity Guard might be your best bet if you're on a budget.

They also provide an annual credit report with three credit bureaus monitored, plus there are many other impressive tools, features, and services included in whichever plan you decide to go for.

Identity IQ

We couldn't compile a top 5 list of best identity theft protection companies without including Identity IQ. There are many different plans to choose from, including family plans, while their most comprehensive plan is the Super Max plan.

They are known for their excellent credit monitoring (3-bureau credit monitoring: Equifax, Experian, and TransUnion are the three credit bureaus they check), and you can receive monthly, bi-annual, or annual credit history reports.

Identity IQ is also known for relatively affordable prices and great customer service. Some of the things included in their plans are dark web monitoring, a secure VPN, and up to $1M cover.

Some of the things they specialise in are anything from health insurance fraud to financial account fraud. They also pay more attention to detecting and preventing social security fraud than almost any other company. They monitor SSNs (social security numbers) for anomalies.

You can look forward to frequent alerts to any changes in your credit scores and personal ID on your accounts. The system detects if new credit/trade lines are opened under your name. They also check checks for national and international arrest and conviction records under your name.

ID Shield

ID Shield is another excellent ID theft protection service for individuals and families. They provide a wide range of services and are one of the best when it comes to identity recovery assistance.

The company monitors your credit/debit card activity for anomalies and provides investment account monitoring services, credit reporting (monthly, from VantageScore)), and superb dark web and social media monitoring. When it comes to ID theft insurance, you are covered up to the value of $2 million.

They even have a specialist team of licensed PIs (private investigators) to deal with ID fraud with unrivalled 24-hour support.

This excellent value-for-money service uses cutting-edge identity theft protection and prevention systems to protect you better, and they have many other useful online security software and tools, plus a VPN.

Step for Getting Started with Aura Our #1 Pick for Identity Theft Protection

If you have decided to subscribe to our #1, most highly recommended identity theft protection service, Aura, you must follow these simple instructions to register your new account.

Signing up is relatively straightforward and will take less than a few minutes of your time. Just follow these simple steps:

Step #1

To go to the official Aura website, where you can register your free account and start your free trial, simply tap or click on any of the secure links to Aura found on this page.

Step #2

You will now be presented with three plans – Family ($37 per month billed annually, or $50 per month billed monthly), Couple ($22 per month billed annually, or $29 per month billed monthly), or Individual ($12 per month billed annually, or $15 per month billed monthly).

Click or tap on the blue-highlighted 'Start Free Trial' button to start your 14-day free trial.

Step #3

When clicking on your preferred plan, the next step is to register your new account by filling out the online application form, which includes your email address, full name, home address, and final info.

By confirming this and starting your trial, you are agreeing to Aura's terms of service and privacy policy. You can now have fun exploring your new account and using its ID theft security services and tools.

The Different Types of Identity Theft

Most people have their heads buried in the sand when it comes to online identity theft and just hope that it never happens to them.

Everyone is at risk from cybercriminals, which is why it's important to understand the different types of identity theft that take place, how common they are, and why you should take measures to prevent being a victim.

Financial Identity Theft

According to recent data, financial identity theft (in its many shapes and forms) is the most common form of identity theft. It's when a hacker, scammer, or cybercriminal uses someone else's personal information (e.g., name, address, email address, identification) for their own personal financial gain.

For example, they might gain access to your debit/credit card number or bank account number to steal money/make unauthorised transactions.

They may even open a new credit card using your social security number. You can track if this has happened to you by checking your accounts regularly and your credit reports.

Tax Identity Theft

This is when cybercriminals (or any other fraudsters) use your personal info to get YOUR tax refund – by filing a tax return in your name.

Always be alert for emails, texts and telephone calls claiming to be the official tax authority in your country. It's usually a scam, as most official government entities would never contact you in this way.

If you have fallen prey to tax identity theft, you must immediately contact your country's tax authority to file a fraud claim and find out what steps you need to take to resolve the issue.

Medical Identity Theft

Medical identity theft is when an unscrupulous individual receives health care by providing the health authority (e.g., the hospital, medical centre, chemist/pharmacy, or any other similar medical/health establishment) who administered the treatment or medication with your details, not their own.

If you pay for medical insurance and find any activity you don't recognise, you must immediately report your findings to your insurer.

Also, go to your local GP (General Practitioner/doctor) and check with them that your medical records are accurate. You don't want to start receiving bills for treatments/medicines you haven't received.

Employment Identity Theft

This is when someone ends up using your personal information to gain employment or, for example, pass a background security/medical check.

Always be alert for anyone contacting you asking for bank account or credit information because they want to carry out a background check, but you haven't even been interviewed for anything. The chances are that someone is using your details to secure themselves a job.

Child Identity Theft

Anyone under the age of 16 will not have a credit report, meaning it opens a window of opportunity for fraudsters to open up a new credit account in their name without them ever realising.

It can take a long while for someone to figure out that this has happened to them, and it can affect them somewhere down the line when they try to get things like credit, employment, or student loans.

Estate Identity Theft

Estate identity theft happens when a fraudster opens an account by stealing the personal information of a deceased person.

To prevent this from happening, the major consumer reporting agencies must be contacted so that a death notice can be added to the deceased person's credit report.

It should ideally be done by a friend, relative, colleague, or executor as soon after someone has passed away as possible.

Criminal Identity Theft

All forms of ID theft are criminal. However, criminal identity theft pertains to anyone who provides your personal information (or anyone else's except their own) to law enforcement after being arrested.

It's hard to detect this kind of ID theft until the consequences of that crime arise. For example, an unpaid speeding ticket in your name may see an arrest warrant issued for you by the judge on the case.

If you think you have been a victim of this type of crime, the best thing to do would be to get in touch with your local law enforcement and explain what you have found.

Synthetic Identity Theft

With this type of ID theft crime, a fraudster will create an identity using information that could be real, fake, or a mixture of both.

For example, this type of criminal carrying out synthetic ID theft may use one person's name but someone else's social security number.

Quite often, deceased people and children are used for this type of crime because their social security numbers are not being used.

Frequently Asked Questions

What exactly is identity theft protection and how does it work?

Identity theft protection is an online service designed to keep your sensitive data out of the hands of fraudsters, hackers, scammers and other cybercriminals.

It is designed to monitor your personally identifiable information (PII, including things like your financial/bank accounts, credit and debit card details, and social security numbers), detect anomalies/unauthorised use of this information, and mitigate any risks associated with stolen PII.

Today's best identity theft companies offer a range of services and carry out a number of duties to safeguard your information and funds from being accessed or used by fraudsters.

As soon as something is detected, you will immediately be notified so you can take the necessary action.

Do I even really need identity theft protection?

In a modern world where cybercrime and identity theft are on the rise, and with sophisticated scamming techniques becoming much harder to detect, you should consider getting some sort of identity theft protection to ensure you aren't an easy target and falling prey to this.

The ten options recommended on this page rank among the best in the world, and they provide services to suit everyone's online security needs, from individuals and couples to small and large families. It's better to be protected than leave yourself wide open to fraudsters.

What kind of impact can having my identity stolen have?

Anyone whose identity is stolen can greatly impact that person's life. Your identity is the most sacred thing that belongs to you, and having it stolen and used by criminals to fund their lifestyles is something you don't ever want to happen to you.

Not only can you lose money, but it can also affect your credit score, which makes it far more difficult in the future to open new lines of store credit, take out important mortgages on any houses you buy, or get any loans you decide to take out for whatever reason.

It can also be physically and mentally draining knowing that someone is going around doing this to you, with very little chance of them getting caught. There's also a chance any PII that's stolen from you remains on the internet/dark web forever if you don't do anything about it.

Is paying for identity theft protection worth the money?

That's completely up to you to decide. Nobody can tell you what you should and shouldn't spend your money on.

However, when it comes to spending money on identity theft protection, most will argue that it's a very good cause.

It could save you a great deal of money in the future because you will be better protected than people who don't pay for an ID theft protection service and are more likely to get your money back if you are a victim.

This kind of protection isn't usually expensive, and there are many plans to choose from.

You may have to cut back on certain other things to afford to pay for your monthly or annual service, but it's definitely worth it in the long run. Even the cheaper services keep you very well protected, meaning you don't have to break the bank.

What should I look for in a good identity theft protection service?

There are many different things to look for in a good identity theft protection service. Some companies provide more protection tools and services than others, and this often boils down to what kind of plan you go for.

Ideally, you should look for an affordable service that best suits you (individual, couple, or family). Some of the things to look for are at least $1 million in insurance coverage, monthly credit reports, credit and ID monitoring, dark web monitoring, ID recovery services, and top-notch customer services.

Also, consider fraud alerts, social/financial accounts monitoring, antivirus/malware software/protection, and maybe things like parental controls, ad-blocking, safe browsing extensions, credit freeze options, two-factor authentication, etc.

How do I know if someone has stolen my identity?

You can do several things to find out if someone may have stolen your identity. For example, regularly check bank statements and bills for goods or services that you didn't purchase.

You may find out your ID was stolen after getting denied for either store credit or a loan because someone stole your identity and ruined your credit score.

Alternatively, a debt collection agency may knock on your front door and ask for money for accounts that were opened in your name but not by you, or you might stop receiving mail in the post or via email from certain financial companies.

How good of a job do identity theft protection services do?

The top ten highest-rated ID theft protection companies suggested on this page protect your ID better than any others.

They are the best at protecting people from falling victim to this common and costly type of fraudulent crime. In short, you're far better off being protected by one of these companies than not being protected.

Is it possible for me to monitor my own identity online?

It is possible for you to monitor your own identity, but it's not recommended. Doing so can take a great deal of time and effort. Subscribing to a well-established company that specialises in monitoring online activity takes out all the hard work and is the safer and more convenient option.

Instead of manually searching online to see if your sensitive personal data or accounts have been compromised, you can continue with your life and let a trusted company do the checks for you 24 hours a day, seven days a week.

If any suspicious activity is flagged, you will be notified immediately so you can take the necessary course of action. Signing up for one of these companies takes the stress away from doing it yourself.

How is it that thieves would even get my information?

One of the most common ways is when fraudsters use phishing email scams, which are becoming increasingly sophisticated by the day, and essentially fool people into handing over their personal or financial information.

Other ways they can get your info is by the pure and simple theft by someone you know, the theft of information from any mail you discard in your trash can, by people purchasing your info that might be up on the dark web, by data breaches on websites where your information is held, weak Wi-Fi networks, skimming, confidence fraud and impersonation scams, fake websites, Vishing, and Smishing, and various other ways.

Should I be checking my credit report on a regular basis?

At a minimum, you should check your credit score at least once per year. You may not care about your credit score, but checking the latest credit score can also reveal other things, like whether your identity has been stolen to open up accounts in your name.

Many people agree that checking your credit score at least once per month is the sensible thing to do.

Conclusion

Each of the identity theft protection services recommended on this page has been thoroughly vetted, and they are well-known to be perfectly secure.

After comparing them to hundreds of other similar companies, our carefully handpicked top 10 were found to offer the best protection services with the most affordable plans to cater to your needs.

Your identity is extremely important, and you must protect it in any way you can, especially when you go online. Subscribing to one of these services can give you much more protection and reduce the risk of becoming a victim of identity fraud.

No company in the world can guarantee to protect you against all the different cyber threats that exist, but they can be a major benefit should you ever become a victim. Plus, they are the best at preventing identity theft crimes from happening.

You must consider how much you want your identity to be protected and then consider how much protection you want and who you want the protection for.

You can then take a look at what each of our suggested companies that specialise in ID theft protection offer before deciding which one to go with.